SMALL BUSINESS FUNDING

Home / Small Business Funding

SMALL BUSINESS FUNDING OVERVIEW

Comparing Your Small Business Loan Options

Funding Bridge LLC has been helping small business owners secure small business loans for more than a decade. We offer a variety of programs that help existing business owners grow their business. We work with all industry types and sizes, as well as have options for all FICO score levels. We have custom tailored business loan solutions for those individuals that have bad credit for reasons such as tax liens, bankruptcy, or late payments and charge-offs. We also offer low rate business loans for those individuals that have excellent credit and for one particular reason or another cannot acquire a loan from a bank. Below you can explore the various business funding option available through Funding Bridge LLC.

Short Term Business Funding

Short-term business Funding is for business owners that are looking for immediate funding that will be paid back over a short period of time. These deals are structured where the business receives funding, and the payback amount and any fees is determined up front. As far as rates and terms this is the best alternative financing option for business owners that do not meet bank requirements. This type of business funding is short term so the payment plan will be spread out anywhere from six months to three years.

Short Term Business Funding

*Rates and fees depend on the duration of funding.

Bad Credit Business Funding

Bad credit business Funding are for business owners with poor personal credit or weak business financials. This type of funding features daily or weekly payments and the fees are determined before funding takes place. This product has very few document requirements and funding can take place as fast as the same day. This financial product is a great option when traditional financing is not a possibility.

Bad Credit Business Funding

*Rates and fees depend on the duration of funding.

Same Day Business Funding

Experience quick and hassle-free solutions with our same day business funding. We understand the urgency of your financial needs, which is why we have streamlined our application process to ensure minimal paperwork. With flexible qualification criteria, you can access funds within hours. Our reliable service has empowered countless entrepreneurs to seize new opportunities, address unexpected emergencies, and keep their business operations running smoothly.

Same Day Business Funding

*Rates and fees depend on the duration of funding.

Unsecured Business Funding

When it comes to financing your small business, look no further than our fast and hassle-free unsecured business funding. Whether you need funds to expand your inventory, upgrade your equipment, or invest in marketing, our loans provide the flexibility you need without requiring collateral. With quick approval and funding in as little as 24 to 48 hours, you can seize immediate opportunities and take your business to new heights. Say goodbye to long waiting times and mountains of paperwork – apply now and experience the speed and convenience of our unsecured business funding.

Unsecured Business Funding

*Rates and fees depend on the duration of funding.

Business Lines of Credit

If you’re a small business owner looking for a funding option that gives you flexibility, our Business Line of Credit is the perfect choice. With this financing option, you have the freedom to get approved for funds without necessarily utilizing the entire amount. Whether you prefer weekly or monthly payment terms, we’ve got you covered. The best part? The cost of financing is based on how much you decide to use from your line of credit. Plus, you can expect a quick turnaround time, with funding available in as little as 2 to 3 days, depending on the size of your credit line. Discover the convenience and freedom of our Business Line of Credit today!

Business Lines of Credit

*Rates and fees depend on the duration of funding.

Merchant Cash Advances

A Merchant Cash Advance provides a flexible financing solution tailored for borrowers who prefer the freedom from fixed payment schedules. With this option, repayments are seamlessly deducted from a small percentage of the credit card revenue as transactions are processed, until the advance is fully paid off. This unique feature empowers merchants to pay less during slower business cycles and contribute more during prosperous times. Experience swift funding within just 3 business days, thanks to minimal document requirements. Explore the best-in-class Merchant Cash Advance solution today!

Merchant Cash Advances

*Rates and fees depend on the duration of funding.

Working Capital Loans

Looking for funding to support your daily operational expenses? Our Working Capital Loans are the perfect solution for small business owners. With flexible payment structures, you can choose daily, weekly, or monthly options that suit your business needs. Say goodbye to lengthy documentation as our streamlined application and funding process can get you the funds as quickly as the same day. Take advantage of this resourceful loan option to keep your business running smoothly.

Working Capital Loans

*Rates and fees depend on the duration of funding.

Business Loans Consolidation

Are you drowning in multiple lines of credit and various business loans or merchant cash advances? Don’t worry, Funding Bridge LLC is here to help you consolidate your business debt. We understand the importance of competitive rates, flexible terms, and working with a trustworthy lender. Take control of your finances and streamline your business with our business loans consolidation services.

Business Loan Consolidation

*Rates and fees depend on the duration of funding.

Discover Your Path to Exclusive Small Business Funding

Which Small Business Funding Solution is Right for You?

Are you a small business owner looking to take your company to the next level? We understand that securing funding is a crucial step in achieving your goals. While it’s tempting to borrow as much as possible, it’s essential to consider what payment plan is manageable for your business and how the funds will be used.

Every business is unique, and that’s why we offer flexible payment options to suit your cash flow. Whether you receive small inflows of cash frequently or larger payments less frequently, we have a payment plan that works for you. Need a short-term loan to cover immediate expenses or funding for a longer-term project? We’ve got you covered.

Understanding your business’s payment capabilities is vital in choosing the right loan for your needs. Discover the possibilities today!

What are the Payments for Small Business Funding?

The amount of each payment depends on your funding amount and the rate you receive. With various payment options available, your payments can be tailored to fit your preferred frequency.

How Often Do You Make Payments?

At our company, we offer a wide range of small business loans, each with different payment options. Whether it’s daily, weekly, or monthly payments, we’ve got a solution that suits your business’s unique needs. Explore our payment options now and find the perfect fit for your loan. Please note: Merchant cash advances have a slightly different payment structure, with a percentage taken out of your sales as they are processed. Get started on your journey to financial growth with us today!

Daily Payments

With this payment option, funds will be withdrawn daily, Monday through Friday excluding holidays, until your account is fully settled.

Weekly Payments

With this option, funds are withdrawn weekly, with one payment per week until the account is settled.

Monthly Payments

With this option, payments are made monthly, one payment per month, until the account is fully settled.

Insight Into the Actual Costs of a Business Funding

What is a Factor Rate?

Factor rates might seem a bit elusive at first glance, presented in decimal form rather than the more familiar percentage. However, to streamline the process, we’ve tailored our calculator to work with percentages. For instance, a factor rate of 1.17 translates to a 17% cost on your borrowed amount, while a factor rate of 1.45 equates to 45%.

Consider this scenario: If you secure a loan of $5,000 with a factor rate of 1.125 (a creative adjustment from the original 25%), you’re looking at a repayment sum of $6,250. This total is fixed, irrespective of how swiftly you choose to repay the loan—even if you opt for an early settlement.

It’s essential to note the stark difference between factor rate and APR. Factor rates are determined up front utilizing the original borrowed amount whereas APR is continuously calculated on the outstanding debt.

Calculating the Cost of Your Small Business Funding

As a business owner, you possess the keenest insight into your company’s financial landscape. Determining the affordability of a deal requires a thorough analysis of your business’s operational margins. Whether you’re gearing up for a promotional drive to boost sales or strategizing to reduce debt financing costs, it’s imperative to project the revenue that the additional capital will generate.

Before taking on a deal, it’s wise to consider every angle of your business plan, including the potential risks and the impact of additional debt on your company’s future. Use the provided calculator to estimate the repayments and total payback amount. Weigh your current and projected cash flow against the debt to ascertain the feasibility of the loan. These considerations are vital in deciding whether a business loan is a prudent financial move for your company.

Additional Fees From Lenders

When planning the repayment of a small business loan, it’s critical to account for all the additional fees in your calculations. It’s worth noting that each lender operates differently, with their own unique set of fees that may differ significantly from others in the market. Although Funding Bridge LLc typically does not charge many of the fees that are common among other lenders, being aware of these potential costs is essential for accurate financial planning.

Origination Fee

The origination fee is essential for processing your loan. It encompasses administrative costs, application verification, and other expenses related to approving your application and transferring the funds to your business bank account. This fee is typically expressed as a percentage, ranging from 1% to 5%, although certain lenders may charge a flat fee.

Application Fee

This fee is required for processing your application, regardless of whether it is approved. It covers the expenses associated with conducting credit checks and basic administrative tasks to initiate the small business loan process. While some lenders may waive this fee when funding is provided, many lenders do not charge an application fee at all.

Late Payment Fee

This fee is applied when a borrower fails to make a payment on the due date. Many modern loan programs offer automatic payment options, where borrowers do not need to manually submit payments. However, if there are insufficient funds in the account, some lenders may charge a late payment fee for each unsuccessful attempt to withdraw the payment.

Pre-Payment Fee

A prepayment fee or penalty is a charge imposed by certain lenders when a loan is fully repaid before its maturity. However, in the alternative financing industry, this concept is non-existent. In fact, it is quite the opposite. Some lenders even provide a discount for prepaying your loan. It is essential to familiarize yourself with your prepayment options before accepting the funding.

We Will Help You Get Your Small Business Loan Application Ready

Does My Credit History Matter

Your credit score is a key factor in obtaining small business Funding. While it may not be the sole determinant of approval—since we facilitate loans for clients with FICO scores as low as 500—it does significantly influence the rates and terms of your loan. A lower credit score suggests a higher risk, which can affect the cost of your deal. If favorable rates and terms are essential for your business funding to be viable, it’s advisable to take certain measures to improve your credit beforehand. We recommend reviewing our guide to repairing credit or possibly our guide to understanding the different types of credit history for more information.

What are Lenders Looking for in an Application

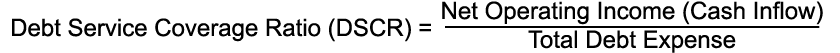

The Debt Service Coverage Ratio (DSCR) is a way for lenders to figure out what kind of loan payments your business can afford. It’s a simple math problem: you take the money your business makes before expenses (cash inflow) and divide it by your yearly loan payments (debt expense). This shows if your business earns enough to pay back the debt. For example, if your business makes $140,000 a year and owes $100,000 in loan payments, your DSCR is 1.40. Lenders also looImagek at other money sources, what you own, how your business does throughout the year, and other things. But how much money your business brings in is a big clue to what it can pay back. Here’s a quick look at the DSCR calculation.

Bank Payment History Your business’s banking track record is scrutinized through your bank statements. Frequent negative balances can be a red flag, making it tougher to secure funding. Ideally, lenders prefer to see fewer than 3 to 5 days with negative balances per month. They also evaluate the number of deposits you make, which reflects your cash flow. Additionally, lenders assess whether your business’s revenue is on an upward or downward trend and the recency of your last revenue generation.

Outstanding Loans Existing small business loans can influence your eligibility for additional funding. While some lenders may offer additional financing, your Debt Service Coverage Ratio (DSCR) will be a critical factor in their decision-making process.

Business Industry The sector your business operates in matters to traditional lenders. Industries known for robust cash flow are typically favored. On the other hand, industries with weaker cash flow patterns may face more rigorous underwriting standards and can be more challenging to finance.

Rent/Lease Agreements Timely payments on your business’s rent or lease, as well as the duration remaining on your lease, are details lenders consider important. These factors can affect the terms and approval of your funding.

What are Common Documents Required for Small Business Funding

The financial industry now provides a diverse range of small business funding products to cater to different needs. Being prepared when you apply ensures optimal funding results for your business. The documentation required by lenders depends on the chosen loan type and your company’s financial health. For instance, bad credit business loans require minimal paperwork, while prime business loans may necessitate a more extensive list of documents due to the favorable rates and terms they offer. Read our guide on the most common types of documents required when applying for business loans for more information on the topic.

Bank Statements. A typical application requires the submission of 3 to 4 months of bank statements. Larger loans may require up to 12 months

Business Licenses. Certain business licenses or certifications may be required depending on the state.

Proof of Business Ownership.Typical documents like articles of incorporation or related documents depending on your business structure may be required.

Lease Agreement for Business Property. If you pay rent or utilize a location for your business you may be required to submit a copy of your lease.

General Identification. Your personal identification is required. Be prepared to submit a copy of your driver’s license or the equivalent.

Possible Additional Documents Required for Small Business Loans Above $150,000

Personal Tax Returns. The application process for larger loans will also require that you verify your personal income with personal tax returns for up to 2 years

Business Tax Returns. The application process for larger loans will require up to 2 years of the most recent tax returns for your business. If you do not have business tax returns because of the way your business is structured then other forms of supporting documents may be required.

Balance Sheet. The application process for larger loans may require a look at your most recent balance sheet to determine the financial health of your business.

Profit and Loss Statement. To complete your application for larger loans you may have to provide Profit and Loss statements (P&L) for the two most recent years. This insight will help determine what type of payment structure is viable for your business.

Business Debt Schedule. For larger loans you may be required to submit a business debt schedule. This is more insight for determining what type of payments can work for your business.

Apply Directly to One Small Business Loan Source

How to Get Funded by Funding Bridge LLC

Submit Online Application

Complete our simple online application by answering a few straightforward questions.

Choose Funding Option

Talk with our team of experienced business loan experts to find the perfect funding option for your needs.

Get Your Funds

Submit your supporting documents and effortlessly transfer the funds to your account.

Typical Uses for Our Business Funding

Expand your business and reach new heights

Boost profits with immediate opportunities

Acquire inventory or equipment for excellence

Attract new customers through powerful marketing efforts

Enhance your online presence with a stunning website upgrade

Invest in impressive construction or location upgrades

Settle outstanding debts for limitless potential

Unlock a world of immediate profit opportunities

And so much more…

Typical Funding Bridge Applicants

Small Business Owners in Every Industry

Denied for a Bank Loan

Bad Credit Problems

Need For Immediate Business Funding

Current Lender Cannot Fund You

Need A Big Business Loan

Need A First Time Business Loan

Frequently Asked Questions

How fast can I get a business loan or funding?

We have witnessed numerous small business owners who have successfully secured funding on the very same day they applied, contingent upon their level of preparedness with the required documents and other contributing factors.

How will this affect my credit?

You can establish a strong business credit history by maintaining a healthy account throughout the duration of your loan.

Can I use the funds for anything I want?

Yes, you are free to utilize the funds in any way you wish. There are no restrictions on how you can use them

Do I need good credit?

No, we have programs available for all credit types. What matters more is that you have a business generating revenue and the necessary banking statements to support it.

Will my information be sold or traded?

Funding Bridge LLC is committed to protecting the privacy of our customers. Unlike other companies, we do not sell your information to third parties. When you choose us, you can rest assured that all your loan applications and inquiries are handled internally. With us, there will be no unwanted phone calls from multiple lenders bothering you. Trust Funding Bridge LLC for a secure and hassle-free lending experience.

Do you need 100% ownership?

No, it is not necessary to have 100% ownership. However, owning a minimum of 51% of the business is required

How many months in business do I need?

A minimum duration of 2 months is necessary, although it is more customary for approved businesses to have been operating for at least 3 months or a longer period.

Is there a prepayment penalty?

No, in certain instances, you may actually be eligible for a discount. In fact, our company goes above and beyond to provide our valued customers with potential savings. By carefully assessing your unique circumstances, we aim to offer tailored discounts that suit your needs.

Have any Questions?

Do you have a question?

Our team of Funding advisors can provide you with the answers you need.

Get in touch today and let us help you find the funding solutions you’re looking for.

Call us at (631) 519-8132

Copyrights 2024 | Funding Bridge LLC™ | Privacy Policy